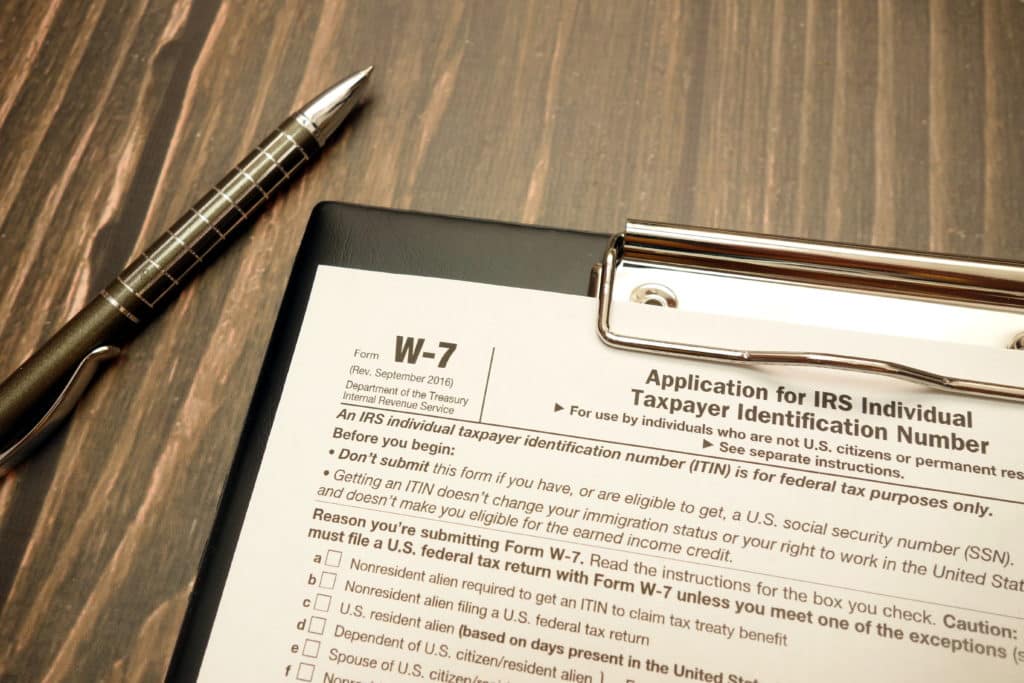

Last Round of ITINs Set to Expire December 31, 2020

The last round of Individual Taxpayer Identification Numbers (ITINs) based on the middle digits are set to expire on December 31, 2020. Learn more about who should renew and how to renew ITINs by reading the IRS’ press release issued August 17, 2020 here. As a reminder, our firm’s office manager, Qulanda Moore is a […]

Last Round of ITINs Set to Expire December 31, 2020 Read More »